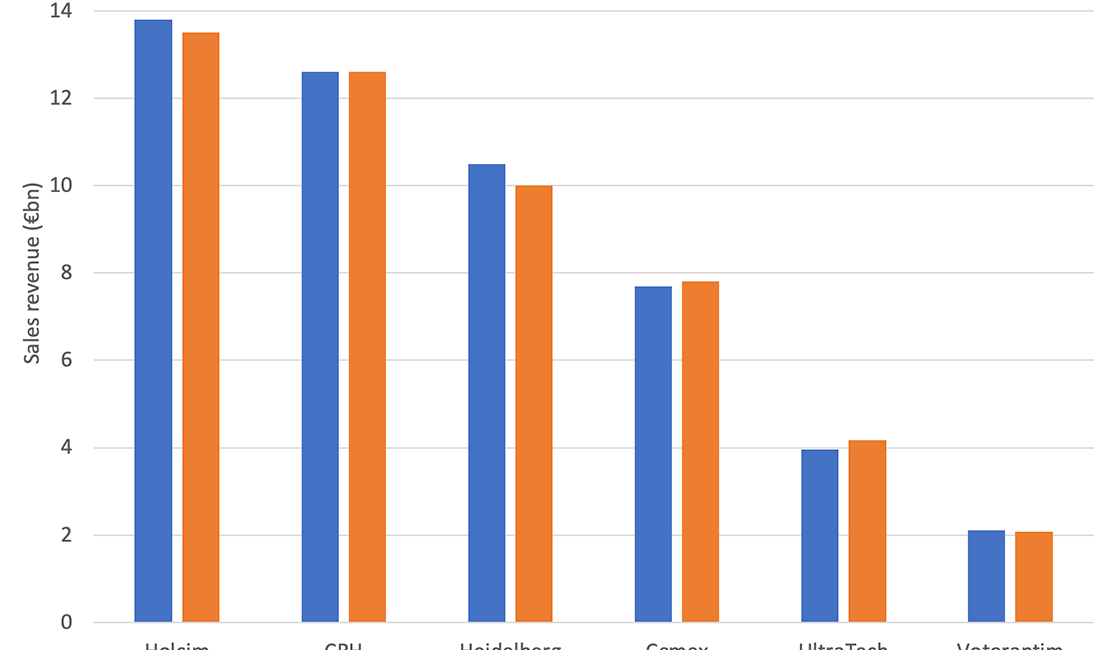

The first half of 2024 has been a period of mixed outcomes for major cement producers, with a general trend of sluggish sales but stable or growing earnings. Votorantim Cimentos, along with other key players such as Holcim, CRH, Heidelberg Materials, and Cemex, released their half-year results, providing insight into the industry’s performance so far this year.

Votorantim Cimentos reported slightly lower net revenue and adjusted earnings for the first half of 2024, primarily due to weaker performance in North America and Brazil during the first quarter. However, a stronger second quarter in Brazil helped stabilize the half-year results. The company faced a slowdown in demand in North America, though strategic price increases mitigated some of the impact. Meanwhile, its operations in Europe, Africa, and Asia showed positive results, with increased revenues driven by higher volumes.

Similarly, CRH reported stable revenue but increased earnings, bolstered by its acquisitions in Texas and a majority stake in Australia’s AdBri. However, its Europe Materials Solutions division saw a 5% revenue decline, attributed to subdued markets and unfavorable weather conditions in Western Europe.

Heidelberg Materials faced a tougher start to the year, with a 5% drop in revenue, largely due to declining sales volumes across all business lines. The company attributed this to weak construction activity and adverse weather in key markets. However, it managed to slightly increase its result from current operations, thanks in part to falling material costs, including energy.

Cemex also reported flat net sales but positive operating earnings, with mixed results across its geographical markets. Strong performance in Mexico was offset by declines in Europe, the Middle East, and Africa (EMEA), where sales volumes were affected by geopolitical issues and market dynamics.

In contrast to these Western multinationals, UltraTech Cement, predominantly operating in India, saw a 6% increase in revenue to €4.2 billion, making it the best performer among the selected companies. The company’s domestic sales volumes grew at a similar rate, and it benefited from a 17% reduction in energy costs, primarily due to lower fuel prices.

The overall picture for the first half of 2024 suggests that while the U.S. market has cooled somewhat since 2023, earnings have remained resilient, and major cement producers continue to view the market optimistically. Europe presented a mixed scenario, with weaker performance in the west contrasted by stronger markets in the east. Notably, the reduction in energy costs following the initial shock from the Russia-Ukraine conflict has provided some relief across the board, benefiting both Western multinationals and regional players like UltraTech Cement.

As the year progresses, the cement industry will be closely monitoring market conditions and cost factors, with future updates expected to shed light on the performance of large China-based cement companies in 2024.

News sourced from globalcement.com

Find out more about the future of building sustainably. Discover the latest in cement industry innovations, best practices, and decarbonization efforts at our upcoming events – join us to shape a greener world!

Dive into our calendar of events, featuring CarbonZero Global Conference and Exhibition 2024 in Madrid, Spain; Women in Cement and Construction International Congress and Sustainability and ESG International Summit 2024 in Madeira, Portugal. Email us at contact@industrylink.eu for program brochures and registration details.

Sign up to our newsletter on industrylink.eu/#signupnow to receive the latest news and future events info as well as exclusive discounts.